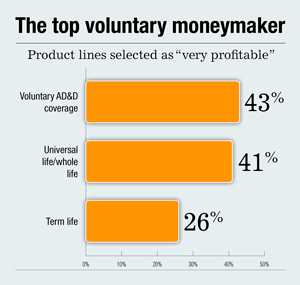

voluntary life and ad&d coverage

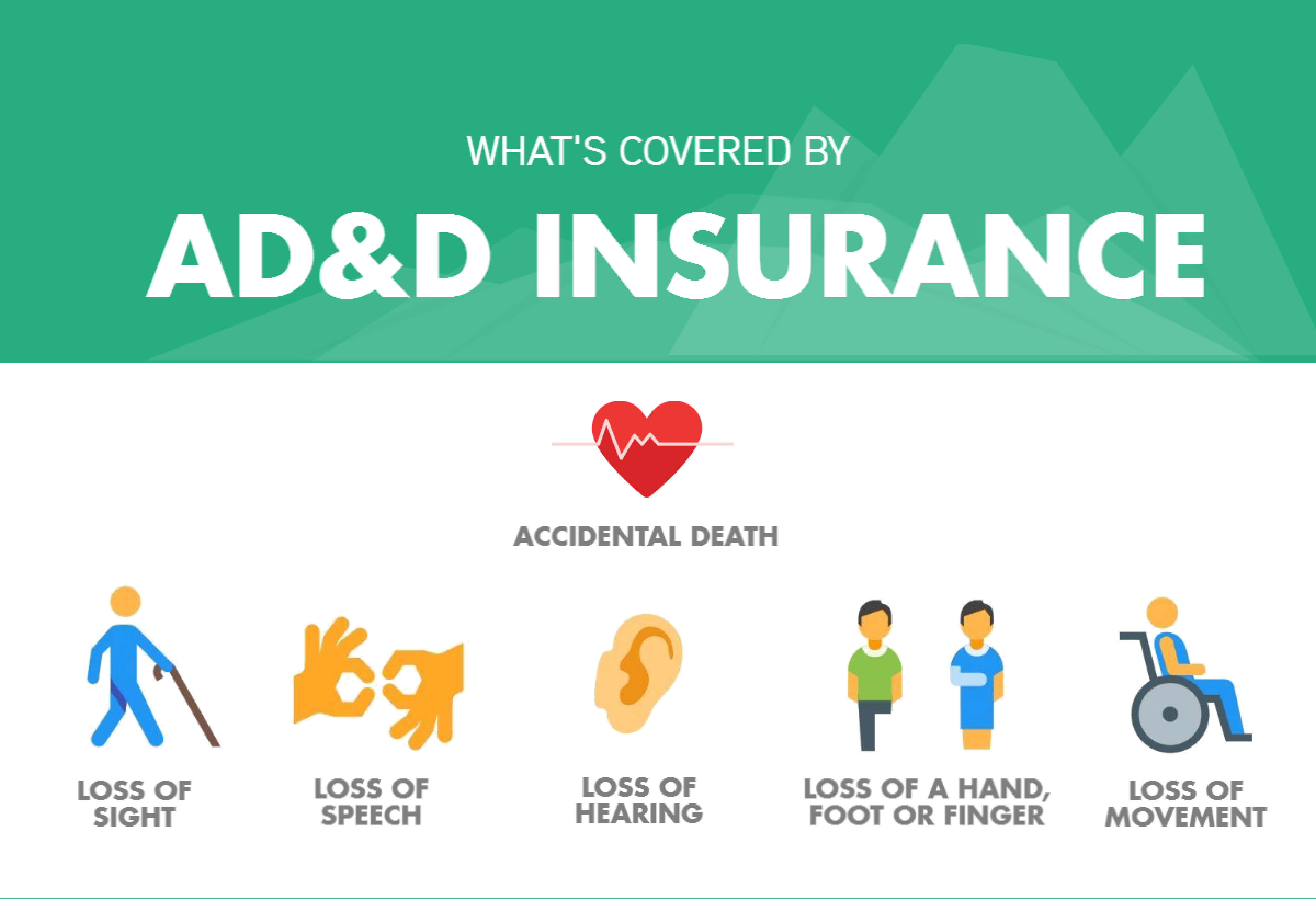

ADD insurance is not a. Accidental Death Dismemberment ADD insurance pays a lump sum if an employee dies or loses a limb in a covered accident that could not be prevented.

Unum Insurance Disability Insurance Life Insurance Financial Protection

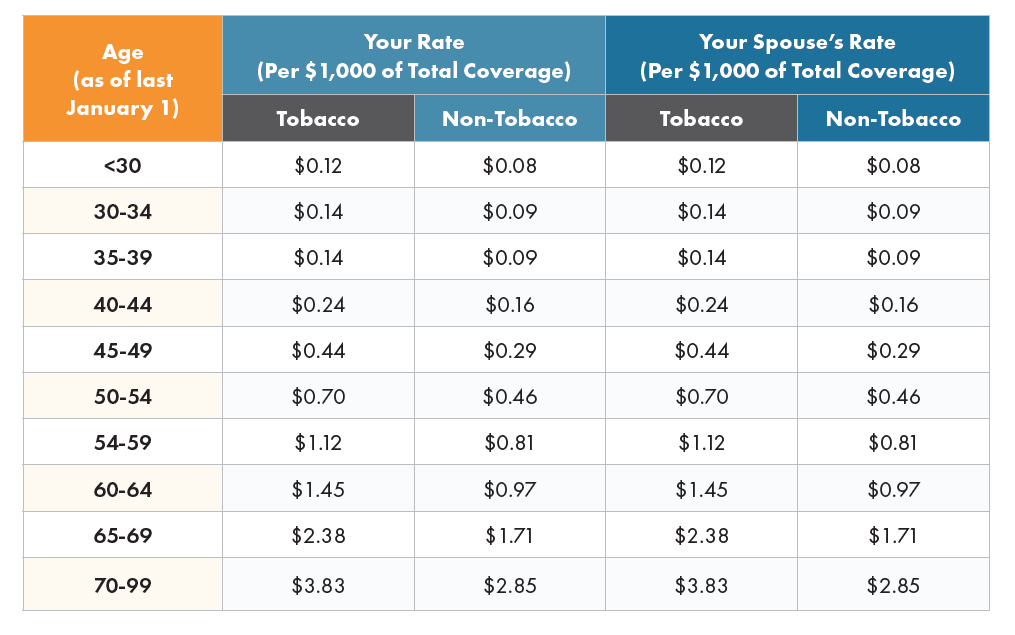

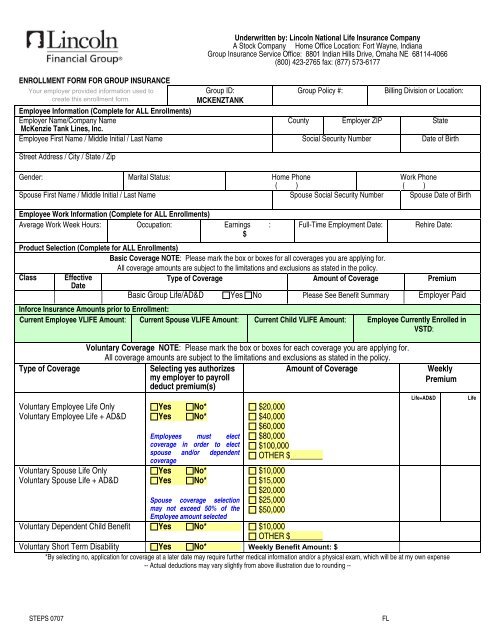

Selecting coverage for voluntary term life and ADD through Lincoln Financial Group is optional.

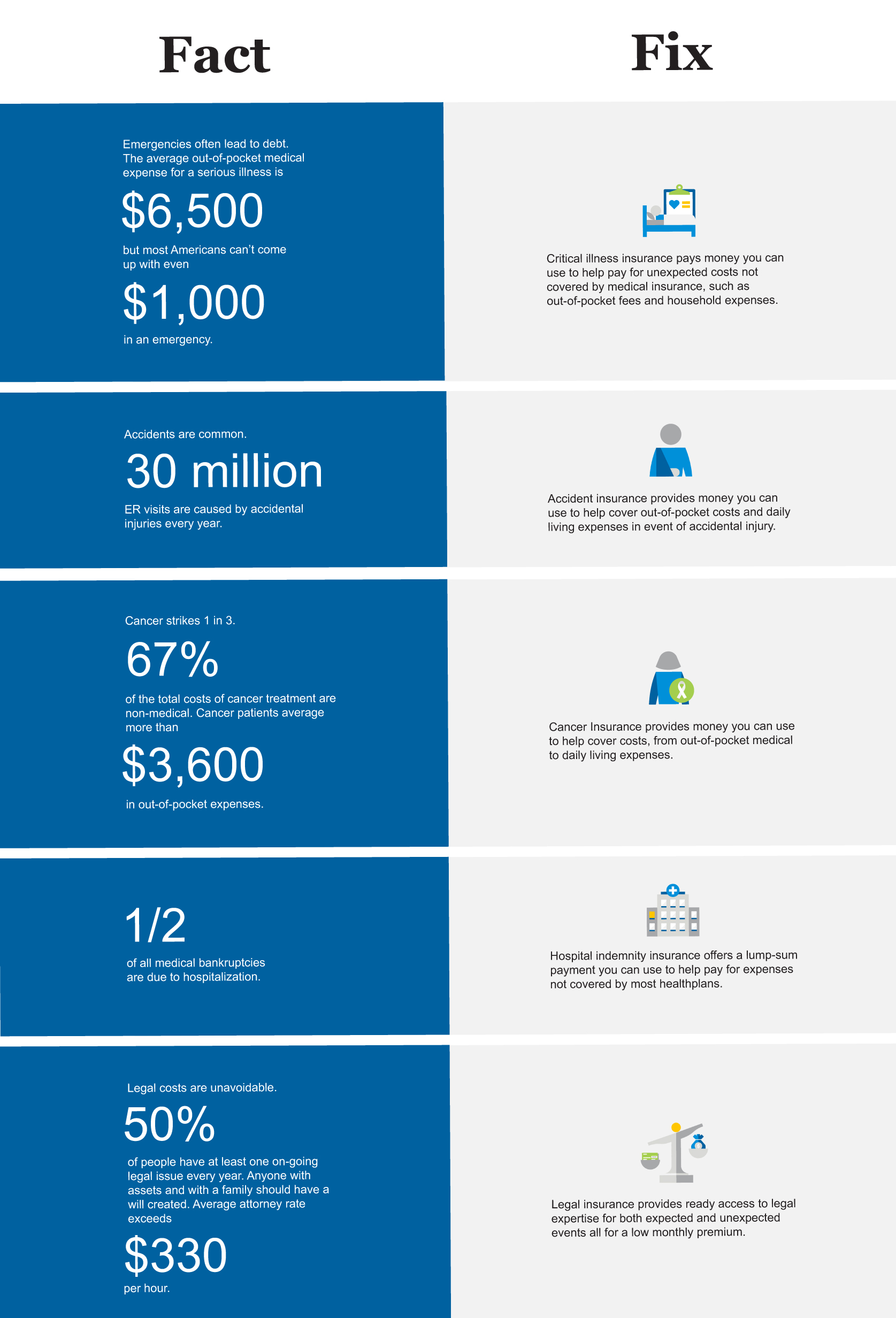

. It also provides compensation for specific. For example monthly premiums might start at 450 for every 100000 in accidental death. The cost of ADD insurance is lower than that for traditional life insurance because the coverage is limited to accidents only.

An ADD policy may be a good idea especially if you work in a high-risk job. A dependent are covered for both voluntary ADD and the medical insurance plan offered by UT System we will reim-burse each eligible survivor for medical insurance premium in an amount. Voluntary accidental death and dismemberment ADD ADD insurance covers deaths due to accidental causes such as a fall.

Is Voluntary life ADD worth it. In general ADD insurance costs are tied to the amount of coverage you purchase. There is some overlap between voluntary life insurance and ADD insurance but they are not the same.

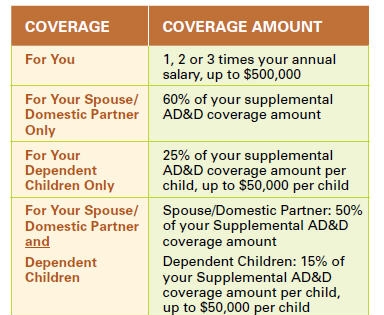

Voluntary group accidental death and dismemberment ADD insurance is a simple way for employees to supplement their life insurance coverage with additional. Accidental death and dismemberment Insurance ADD is an insurance policy that offers coverage in case a person dies or becomes disabled. People with riskier jobs pay higher premiums than people with low.

Voluntary life insurance is an optional benefit provided by employers that provides a death benefit to a beneficiary upon the death of an insured employee. ADD insurance covers you if you die from an accident or have suffered a. When Your Coverage Begins and Ends If you elect Accidental Death and Dismemberment Insurance your Accident insurance begins when your voluntary Life insurance coverage.

It is paid for by a. ADD covers death by. Deaths due to prior medical.

The premiums are tied to the amount of. Voluntary Accidental Death and Dismemberment VADD is an affordable limited form of life insurance that provides a cash benefit in the event of a fatal or disabling accident. Voluntary accidental death and dismemberment ADD is a limited life insurance coverage that pays the policyholders beneficiary if the policyholder is.

This insurance is a voluntary benefit and employees who choose this. Rates shown are guaranteed until October 01 2019 Monthly. Life insurance and ADD insurance both provide a death benefit to your beneficiaries.

The cost for Voluntary Life is calculated based on the age of the employee at the start of the plans current policy year. What is voluntary ADD Accidental Death and Dismemberment.

Utah Group Life Insurance Ad D Insurance Fringe Benefit Analysts

Benefits Voluntary Life And Ad D

What Is Voluntary Life Insurance Ramsey

What Is Voluntary Life Insurance Do I Need It Quotacy

Group Voluntary Term Life Insurance Ppt Download

Voluntary Life And Ad D Washington Schools

Policy 1 Basic Life And Ad D Insurance Spokane Fire Fighters Benefit Trust

Accidental Death And Dismemberment Ad D Insurance Awesomefintech Blog

Voluntary Life And Ad D Insurance Valuepenguin

What Is Supplemental Life Insurance Ramsey

Accidental Death Dismemberment Ad D Insurance

Enroll In Securian Voluntary Life Insurance Feb 14 March 4 University Human Resources News

5 Star Life Basic Life And Ad D Voluntary Group Term Life Insurance

Voluntary Employee Insurance Benefits Metlife

Ad D Coverage Infographic Texas Bar Private Insurance Exchange

Ad D Insurance Accidental Death The Hartford

Basic Group Life Ad Amp D Yes No Employer Paid Voluntary Coverage